Quick Links

Contact Us

Send a Message

Newsletter

We will get back to you as soon as possible.

Please try again later.

Trump Tariffs 2.0 -- A Bump in the Road for Equities?

Tariffs are worthy of some attention because they can be impactful for the economy ...

By Ian Mahmud, Principal

On Truth Social after the election, then President-elect Trump said he would implement 25% tariffs on all products from both Canada and Mexico on “Day 1.” Trump more recently committed to a 10% tariff on all Chinese products sold in the United States. Trump commented to a reporter in the Oval Office that tariffs may be implemented “February 1.”

Tariffs are worthy of some attention because they can be impactful for the economy and because they can be enacted via executive order. Many economists and journalists have examined the potential impact of a 25% tariff on all products from Canada and Mexico, coupled with a 10% tariff on all products from China. The Washington DC based Tax Foundation, for example, estimates that the tariffs on Canada, Mexico and China would reduce long-run U.S. GDP by 0.4% (0.3% from the Mexico / Canada tariffs and 0.1% from the tariffs on China). Their analysis excludes the impact of any potential retaliatory tariffs.

However, we believe reviewing Trump’s tariffs from his last presidency is perhaps more helpful in understanding what may happen next and evaluating the potential impact on US equity markets. The tariffs during Trump’s first term focused on products from China and on steel and aluminum products from many countries.

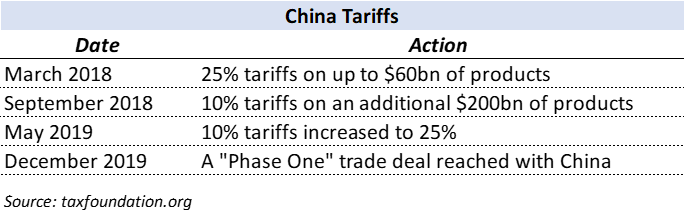

China Tariffs: In March 2018, the Trump administration pursued tariffs on targeted products from China, including a tariff of 25% on up to ~$60bn in products. In September 2018, a 10% tariff was placed on an additional ~$200bn in products. In May 2019, the 10% tariff was increased to 25%. Over the following months, the administration continued to expand the number of targeted products and aimed to increase tariff rates. However, by December 2019, a “Phase One” trade deal was reached with China wherein many contemplated tariff increases were not implemented.

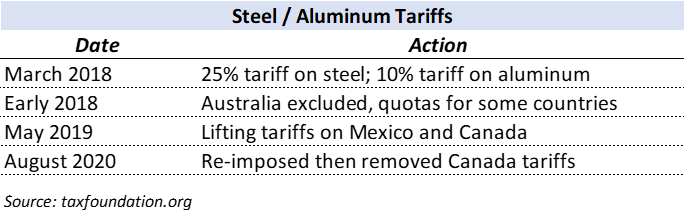

Steel and Aluminum Tariffs: In March 2018, a 25% tariff was implemented for all steel imports and 10% for all aluminum imports. Many countries were given exemptions from the tariff. Later in 2018, additional exceptions and tariff reductions were given. Australia was fully exempt and a quota system (rather than a blanket tariff) was implemented for steel products from Brazil and South Korea. A quota system was implemented in place of a tariff on aluminum products from Argentina. In May of 2019, the administration lifted all steel and aluminum tariffs from Canada and Mexico. Subsequently, there was some expansion in scope of these tariffs and tariffs on Canada were briefly re-imposed before being lifted again.

Stock Market Performance: The stock market did not perform well in 2018. For the year, the S&P 500 declined by 6.2% (excluding dividends). Many journalists and Wall Street analysts point to the US tariffs (and the resulting retaliatory tariffs) as an important driver for the market declines. However, we would also observe that the biggest swoon in the market occurred toward the end of 2018 when the Fed increased interest rates by a quarter point. In our view, the rate hiking cycle may have been more impactful for the market than the tariffs and concerns about their impact on GDP growth.

Further, the “Trade War” period can perhaps be best defined as beginning in March of 2018 when the initial China and steel / aluminum tariffs were imposed to the end of 2019 when the “Phase One” agreement was reached with China. By the end of 2019, the more serious escalation of tariffs generally came to a halt. During that time (from March 1, 2018 to December 31, 2019), the S&P 500 rose ~20%.

The implementation of tariffs during Trump’s last presidency was followed by negotiations and reductions in tariffs over time. Many of the tariffs did remain in place. However, tariffs were not far reaching or high enough to severely weaken the U.S. economy. Stocks for the leading U.S. companies were able to perform well, driven by a still growing economy, improving earnings and a more accommodative Fed.

This time around, Trump has said the tariffs would apply to almost all goods from three countries (Canada, Mexico and China), rather than just products sold by targeted industries. However, if history repeats itself, we could see the initial policy position followed by negotiation, de-escalation and reduction in tariffs over time. In the short-run, we might see the stock market react negatively to tariffs and retaliatory tariffs. Beyond that point, we think corporate earnings (which admittedly could be influenced by tariffs), Fed policy and potentially a further reduction in corporate tax rates will be the more important drivers for US equities.

Source: YCharts

If you have any question about tariffs or other topics, reach out any time (413) 256-1225 x2 or info@westbranchcapital.com.

The views and information contained in this article and on this website are those of West Branch Capital LLC and are provided for general information. The information herein should not serve as the sole determining factor for making legal, tax, or investment decisions. All information is obtained from sources believed to be reliable, but West Branch Capital LLC does not guarantee its reliability. West Branch Capital LLC is not an attorney, accountant or actuary and does not provide legal, tax, accounting or actuarial advice.

Recent Articles

Categories

Important Links

Subscribe to our newsletter

Newsletter

Thanks for subscribing to our newsletter.

Please try again later.

Our Locations

Contact Us

Send A Message

Footer Form

We will get back to you as soon as possible.

Please try again later.

West Branch Capital was recognized by investor.com as a 5-star rated firm in 2024. View our profile. To learn more about the trust algorithm, visit https://advisorsearch.org/rias/trust-algorithm.

The Financial Times 300 Top Registered Investment Advisers is an independent listing produced annually by the Financial Times (June, 2017). The FT 300 is based on data gathered from RIA firms, regulatory disclosures, and the FT’s research. The listing reflected each practice’s performance in six primary areas: assets under management, asset growth, compliance record, years in existence, credentials and online accessibility. This award does not evaluate the quality of services provided to clients and is not indicative of the practice’s future performance. Neither the RIA firms nor their employees pay a fee to The Financial Times in exchange for inclusion in the FT 300.

All Rights Reserved | West Branch Capital