Quick Links

Contact Us

Send a Message

Newsletter

We will get back to you as soon as possible.

Please try again later.

Midyear Bond Update

As the second quarter began, interest rates resumed their uptrend after having declined earlier this year. Several inflation readings indicated inflation had stopped falling, with some measures showing upticks in price pressures. The Federal Reserve has a dual mandate of maximum employment and price stability. While prices have come down, inflation remains above the Fed’s target of 2%. After ten interest rate increases the economy remains firm with only employment showing some signs of softening. The Federal Funds rate at 5-5.25% is the highest in over 22 years.

However, by mid-May signs of cooling inflation ignited a bond rally. Bond prices rose sharply and pushed down the yield on the 10-year US treasury note. The yield on the 10-year ended the quarter at 4.35%. This is down from close to 5% in the first quarter and as high as 4.7% early in the second quarter. At the Fed’s meeting in June officials indicated they expect only one rate cut this year; down from as many as six cuts expected by investors in January. Despite the possibility of just one rate reduction, bond prices marched higher as investors believe that the recent streak of surprising price jumps, during the first few months of the year, was more of an aberration than a break in the trend of inflation moderating.

The rapid increase in interest rates has little historical precedent. The full impact of the Fed’s actions has not yet worked its way through the economy. When the Fed raised rates in the past, it often lifted them to the point that the job market weakened, causing the economy to slow which then led them to reverse course and cut rates. Despite high interest rates, this has not occurred. Reasons cited are strong income growth, record stock prices fueling portfolio gains and driving consumer optimism, and excess savings from pandemic relief funds. The yield curve remains inverted but less so with the two- to ten-year spread at -40 basis points compared to -106 basis points one year ago. When short term rates are higher than long term rates it implies investors’ preference to lock in long term rates with the expectation that the Fed will ultimately reduce rates. Typically rate reductions are in response to a weakening economy which is a precursor to a recession. The timing of a recession is uncertain, but we think it is likely to occur sometime later this year or early in 2025.

We expect interest rate reductions will come if either inflation retreats closer to the Fed’s target of 2% or the economy weakens, and a recession looms. If inflation declines closer to 2% and the economy avoids a recession, then a soft landing will have been achieved meaning low inflation without an economic slowdown. In this scenario the Fed will reduce rates but cautiously to avoid stoking inflation. Stocks should do well, and interest rates will decline slightly. A soft landing is not our expected outcome. If the rate reduction is due to an economic recession, then stocks may come under pressure while bond yields should decline as the Fed will reduce rates more aggressively. We believe this is the more likely outcome.

Why it may be an opportune time to extend out on the yield curve, and a review of Breakeven Yields

Interest rates have risen at an unprecedented pace. One year ago, we looked at breakeven yields on three maturities of US treasury securities; that is, how high do rates need to go up in one year to breakeven or not lose money on that maturity? Here is what we calculated:

The above table shows a two-year bond purchased on 6/30/23 where the 4.9% yield to maturity would need to increase to a yield greater than 10.18% in one year for it to result in a negative return. The other maturities are shown above. These levels were not reached on 6/30/24 (last column) and only the 10-year came close. Essentially, at that time, the bulk of the losses in bond prices had already occurred.

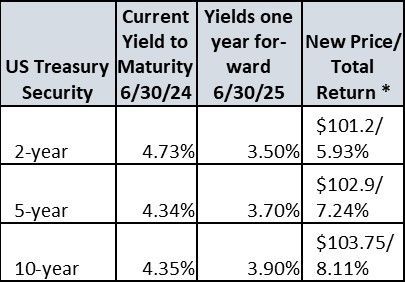

Now with the Fed about to lower rates we can look at returns that can be achieved one year forward by investing in each of these maturities. Since the yield curve should steepen as the Fed reduces short term rates, we will assume a normal upward sloping curve will develop in one years’ time.

* Total return is price change plus coupon payment over one year.

This chart shows that when the Fed eases and yields decline, the yield curve will steepen (short rates declining faster than long term rates). The greatest potential return will come from the longer end of the curve. The more yields decline the greater the advantageous return from longer term securities. Therefore, it may appear risky to extend out on the yield curve, but when rate cuts do occur, longer maturities will perform best even as their yields decline less. While investors should remain cautious given current economic and inflation trends and Fed policy intentions, a modest pivot to maturity extension may be in order.

Since we are in a presidential election year it may be instructive to look at how the Fed might behave. In general, the Fed will be more cautious with major policy changes but will not sit on the sidelines during an election year. It wants to avoid the appearance of influencing the political process. It will continue to pursue its dual mandate of price stability and maximum employment. Any significant policy action would be the result of clear evidence of the need to raise or lower rates. In most election years, the Fed has either raised or cut rates. Since interest rates are already at recent high levels, we are not likely to see interest rate increases. Cuts are more likely given the Fed’s stated intentions. The Fed will be transparent to ensure communication of its intentions and that they are based on economic considerations, not political.

Who wins the election will also matter for Fed policy. A potential Trump victory may result in large tax cuts swelling the deficit and fueling inflation. Imposing sweeping tariffs could also add to inflation. Investors and the Fed will react accordingly.

If you have any questions on this topic, please reach us at (833) 888-0534 x2 or info@westbranchcapital.com

The views and information contained in this article and on this website are those of West Branch Capital LLC and are provided for general information. The information herein should not serve as the sole determining factor for making legal, tax, or investment decisions. All information is obtained from sources believed to be reliable, but West Branch Capital LLC does not guarantee its reliability. West Branch Capital LLC is not an attorney, accountant or actuary and does not provide legal, tax, accounting or actuarial advice.

About The Author

James K. Ho

Jim has over thirty years of investment management experience. He is a Managing Director and Principal of the firm. Prior to West Branch Capital, Jim was a fixed income Portfolio Manager at John Hancock Advisors. Previously, he managed the John Hancock Tax Exempt Income Trust. Prior to joining John Hancock Advisors, Jim was a Senior Investment Officer at The New England (MetLife), where he managed multiple bond portfolios, including taxable and tax exempt mutual funds and separate accounts. Jim holds an M.B.A. from Columbia University, New York, as well as an M.S. in Applied Math and B.S. in Applied Math and Economics from the State University of New York at Stony Brook. He is a Chartered Financial Analyst and a member of the Boston Society of Security Analysts.

Important Links

Subscribe to our newsletter

Newsletter

Thanks for subscribing to our newsletter.

Please try again later.

Our Locations

Contact Us

Send A Message

Footer Form

We will get back to you as soon as possible.

Please try again later.

West Branch Capital was recognized by investor.com as a 2019 Trusted Firm. View our profile. To learn more about the trust algorithm, visit investor.com/trust-algorithm.

The Financial Times 300 Top Registered Investment Advisers is an independent listing produced annually by the Financial Times (June, 2017). The FT 300 is based on data gathered from RIA firms, regulatory disclosures, and the FT’s research. The listing reflected each practice’s performance in six primary areas: assets under management, asset growth, compliance record, years in existence, credentials and online accessibility. This award does not evaluate the quality of services provided to clients and is not indicative of the practice’s future performance. Neither the RIA firms nor their employees pay a fee to The Financial Times in exchange for inclusion in the FT 300.

All Rights Reserved | West Branch Capital