Quick Links

Contact Us

Send a Message

Newsletter

We will get back to you as soon as possible.

Please try again later.

What Drives Portfolio Returns -- Equities or Bonds?

One of the most important questions to ask about any investment account is: “what percentage of the account is allocated to equities (stocks)?”

This is an important question, in general, because equity exposure will increase the volatility of the account. In a strong bull market (like we are experiencing currently), equity allocation is a major driver of positive returns relative to fixed income (bonds) or cash. During a stock market correction (decline), equity allocation will negatively impact performance relative to bonds or cash, therefore, in both instances contributing to large variability of the account value.

It is important to note that these points are generalizations, not rules. There are exceptions. For example, a highly speculative fixed income investment like a junk bond can be more volatile than a high quality defensive stock. Generalizations are best applied to broad market indices (e.g. the S&P 500 and the U.S. Aggregate Bond Index) or baskets of well-chosen high-quality stocks and investment grade bonds.

Because of the increased volatility of equities, they have an especially significant impact on any account during bull and bear markets. While past returns are no guarantee of future returns, equities have also delivered higher returns than fixed income over the long term historically.

In the WBC client portal, you can view the performance of your holdings by asset class (Equity, Fixed Income, others) by clicking “Reports” along the top bar, then selecting “Account Performance” under “Performance” and scrolling down.

Comparing Equity and Bond Returns

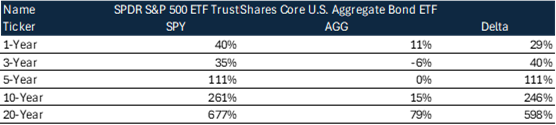

Two of the most widely used performance measures for US equities and US investment grade bonds are the SPDR S&P 500 ETF Trust (Ticker: SPY, which tracks the S&P 500) and the iShares Core US Aggregate Bond ETF (Ticker: AGG, which tracks the Bloomberg US Aggregate Bond Index). Based on these two measures, as shown in the table below, equities have outperformed fixed income significantly.

On a total return basis, equities have outperformed over the last 1, 3, 5, 10 and 20-year periods. Holding the S&P 500 for the last 20 years would have earned a 677% total return. This return is 598% higher than the total return from the bond index.

Table 1: Comparing Equity and Bond Total Returns

The table depicts total return measures meaning that they include dividends paid by equities and coupons paid by bonds in each respective index. These return numbers are not adjusted for inflation which is ~3% over the long term. The way to account for inflation would be to subtract the total inflationary impact over the time period from the return figure. Therefore, the inflationary impact adjustment would be the same for both asset classes.

Asset Allocation and Performance

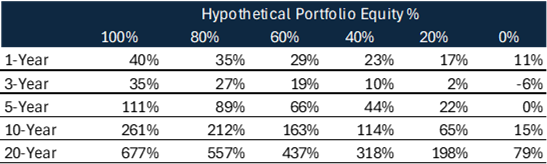

The dramatic difference between equity and fixed income returns impacts portfolio returns. Consider the below table, which shows the total return of hypothetical portfolios with different blends of equity and fixed income. The performance figures for equity and fixed income use the same indices shown in the prior section (SPY and AGG). Over the 20-year historical timeframe, a 100% equity portfolio outperformed the commonly used “60/40 portfolio” by 239%. It is also worth noting that certain individual securities (which also carry increased volatility) can perform significantly better or worse. Apple stock, currently the largest company in the US as measured by market capitalization, is up 32,893% over the 20-year time period on a total return basis.

Table 2: Comparing Historical Returns for Different Equity Allocations (the remainder is allocated to fixed income). Note: The math here is simplified, using a weighted average of each return benchmark.

The magnitude of these differences helps underscore why it is so important to keep equity allocation in mind when understanding account performance. For example, if you are viewing the performance of workplace 401(k) portfolios, you would generally expect one which is 100% allocated to equity funds to have performed better than one with a 60%/40% mix over a long term horizon (such as 10 or 20 years). Conversely, the 60%/40% portfolio might have outperformed during a bear market for equities.

In practice, it can be difficult to determine the equity / fixed income mix of 401(k) accounts. The plans often do not provide the overall account mix to you even if you own only all-equity and/or all-fixed income funds. Adding complexity are target date funds, which generally change the equity and fixed income mix as the funds near their target date year. Similarly, “asset allocation” funds do not always make it easy to identify their asset mix. It is often necessary to review the prospectuses or other fund materials to determine how the funds are allocated – then aggregate for a total portfolio mix.

Equity Portfolio Volatility

Looking at only the long-term performance numbers of equities and fixed income glosses over a key drawback of equities – higher volatility and corresponding declines. While the returns of equities have been superior over the long term, they have also been much more volatile. In 2022, for example, the SPY declined by 19% (offset by a bit less than ~1.5% in dividend income). The AGG declined as well (by 15%), but this was offset by ~4% in bond income. Historically, the drawdowns” (declines from a previous peak) have been more significant for equities than fixed income.

Comparing Equity Returns

Things get more interesting when comparing returns between different investments in the same asset class. Equities are categorized by size (e.g. small cap, mid cap, large cap, mega cap), geography (e.g. United States, Developed Markets, Emerging Markets, Asia ex. Japan), and sector (e.g. technology, industrials, and consumer). Often, they are also given additional classifications for how they might be expected to perform in different economic conditions (e.g. cyclical, counter-cyclical, defensive).

Over the past 10 years for example, US technology stocks have outperformed the broader US index and large caps stocks have outperformed small cap stocks. Digging deeper, certain individual securities with wide business moats and strong growth prospects can outshine their benchmarks, as indicated by the reference to Apple performance above.

Overall, different asset classes will have different impacts on performance depending on market conditions. Increased fixed income exposure can reduce portfolio volatility – especially important if you are focused on wealth preservation or have higher equity exposure in other accounts. Fixed income can also generally provide a higher level of portfolio income relative to equities. Ultimately, how well a portfolio is performing for you depends on the asset allocation decision you make with your financial needs in mind rather than the absolute return figure – as well as your tolerance for any given level of volatility, especially during corrections or bear markets. Everyone likes when the volatility is to the upside, but not the volatility to the downside.

Note: Source is YCharts. Figures as of 10/23/2024.

If you have any questions about this topic, please reach us at (833) 888-0534 x2 or info@westbranchcapital.com

The views and information contained in this article and on this website are those of West Branch Capital LLC and are provided for general information. The information herein should not serve as the sole determining factor for making legal, tax, or investment decisions. All information is obtained from sources believed to be reliable, but West Branch Capital LLC does not guarantee its reliability. West Branch Capital LLC is not an attorney, accountant or actuary and does not provide legal, tax, accounting or actuarial advice.

About The Author

Ian Mahmud

Ian is a Principal at West Branch Capital, bringing 10 years of experience in the financial services industry to the firm. Ian started his career at Barclays in Investment Banking focused on Equity Capital Markets. He then joined the Research Department, as an equity analyst on a three-person Institutional Investor Top 5 ranked team in the country, covering the Medical Technology Sector. He covered the Healthcare Sector as a Coverage Investment Banker at Credit Suisse and most recently was a Mergers & Acquisitions Investment Banker at Centerview Partners in New York. After graduating from Milton Academy, Ian earned a B.A. in Economics (Magna Cum Laude, Phi Beta Kappa, Recipient of the College Key) from Bates College. At Bates, he was the President of the Debate Team, ranked 9th in the world. Ian holds an M.B.A. with a Finance Track Certification from MIT Sloan School of Management. He enjoys golf, tennis and skiing.

Important Links

Subscribe to our newsletter

Newsletter

Thanks for subscribing to our newsletter.

Please try again later.

Our Locations

Contact Us

Send A Message

Footer Form

We will get back to you as soon as possible.

Please try again later.

West Branch Capital was recognized by investor.com as a 5-star rated firm in 2024. View our profile. To learn more about the trust algorithm, visit https://advisorsearch.org/rias/trust-algorithm.

The Financial Times 300 Top Registered Investment Advisers is an independent listing produced annually by the Financial Times (June, 2017). The FT 300 is based on data gathered from RIA firms, regulatory disclosures, and the FT’s research. The listing reflected each practice’s performance in six primary areas: assets under management, asset growth, compliance record, years in existence, credentials and online accessibility. This award does not evaluate the quality of services provided to clients and is not indicative of the practice’s future performance. Neither the RIA firms nor their employees pay a fee to The Financial Times in exchange for inclusion in the FT 300.

All Rights Reserved | West Branch Capital