Quick Links

Contact Us

Send a Message

Newsletter

We will get back to you as soon as possible.

Please try again later.

US Economic Revival

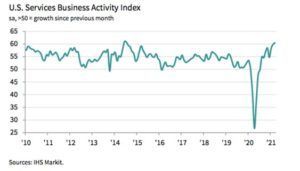

On the third business day of every month, IHS Markit releases a Purchasing Managers’ Index (PMI) for more than 40 worldwide economies. The US Services PMI is based on monthly questionnaire surveys collected from over 400 U.S. companies and cover topics like new business, employment and expectations going forward. And since the services sector accounts for more than 75% of U.S. GDP, the report is closely watched.

On April 5th, IHS Markit ran the headline screaming: “Fastest rise in business activity since July 2014 as new order growth reaches six-year high” and then wrote:

“March PMITM data indicated a substantial increase in business activity across the U.S. service sector, and one that was the steepest for almost seven years. Contributing to the marked upturn in output was the fastest expansion in new business for six years, reflecting strengthening client demand. Firms also registered a renewed rise in new export orders. Meanwhile, rates of input cost and output charge inflation reached fresh record peaks, as firms sought to pass on steep rises in input prices to clients.

Meanwhile, sentiment among service providers about business in the year ahead improved, helping drive employment growth to a three-month high.

The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 60.4 in March, up from 59.8 in February and above the earlier released ‘flash’ estimate of 60.0. The rate of output growth signaled was the fastest since July 2014. Service providers often stated that the stronger expansion in business activity was due to greater client demand and the easing of virus containment restrictions in some states.

At the same time, new business increased further in March, with the rate of growth accelerating for the third successive month. The pace of the upturn in client demand was the quickest since March 2015. Firms attributed the expansion to greater spending by existing customers as well as the acquisition of new clients, often through more sales and marketing activities. Others suggested that higher confidence stemming from the vaccine roll-out had driven up customer spending.

Total sales were also supported by a renewed increase in new export orders, which rose for the second time in the past four months due to increased demand following easing lockdown restrictions in some markets.

On the price front, input costs soared in March. The rate of inflation accelerated to the fastest since data collection for the services survey began in October 2009. Anecdotal evidence widely linked the uptick in costs to higher prices for key inputs such as PPE, paper, plastics, fuel and transportation.

Subsequently, firms sought to pass on higher costs to clients through a sharper rise in selling prices. A number of companies also stated that stronger client demand allowed a greater proportion of the hike in costs to be passed through. The resulting rate of charge inflation was the quickest on record.

Meanwhile, business expectations regarding the outlook for output over the coming year improved in March. The degree of confidence was robust overall and among the strongest for six years. Optimism was commonly attributed to the ongoing vaccine roll-out and hopes of a substantial boost to new sales if social distancing measures are further eased during 2021.”

More Data Later This Week

More economic data will be released later this week, including Jobless Claims on Thursday and final PPI data on Friday.

Sources: markiteconomics.com and FMeX

About The Author

Ayaz Mahmud

Ayaz brings almost thirty years of investment management experience to West Branch Capital. He serves as the firm’s Chief Executive Officer. Ayaz founded West Branch Capital in 2004 after spending over twenty years as a top wealth advisor at premier global investment banks: Kidder Peabody, Smith Barney and Lehman Brothers. At Lehman Brothers, he helped build the Wealth Management Group in Boston and co-managed the Equity and Fixed Income Middle Market Institutional Trading Desks. Ayaz has managed client portfolios throughout his career. Ayaz holds an M.A/M.B.A and a B.A/B.S from Syracuse University.

Important Links

Subscribe to our newsletter

Newsletter

Thanks for subscribing to our newsletter.

Please try again later.

Our Locations

Contact Us

Send A Message

Footer Form

We will get back to you as soon as possible.

Please try again later.

West Branch Capital was recognized by investor.com as a 2019 Trusted Firm. View our profile. To learn more about the trust algorithm, visit investor.com/trust-algorithm.

The Financial Times 300 Top Registered Investment Advisers is an independent listing produced annually by the Financial Times (June, 2017). The FT 300 is based on data gathered from RIA firms, regulatory disclosures, and the FT’s research. The listing reflected each practice’s performance in six primary areas: assets under management, asset growth, compliance record, years in existence, credentials and online accessibility. This award does not evaluate the quality of services provided to clients and is not indicative of the practice’s future performance. Neither the RIA firms nor their employees pay a fee to The Financial Times in exchange for inclusion in the FT 300.

All Rights Reserved | West Branch Capital